Cash Rate

On October 8 the Reserve Bank reduced its Official Cash Rate by 50 basis points to 2.5 per cent.

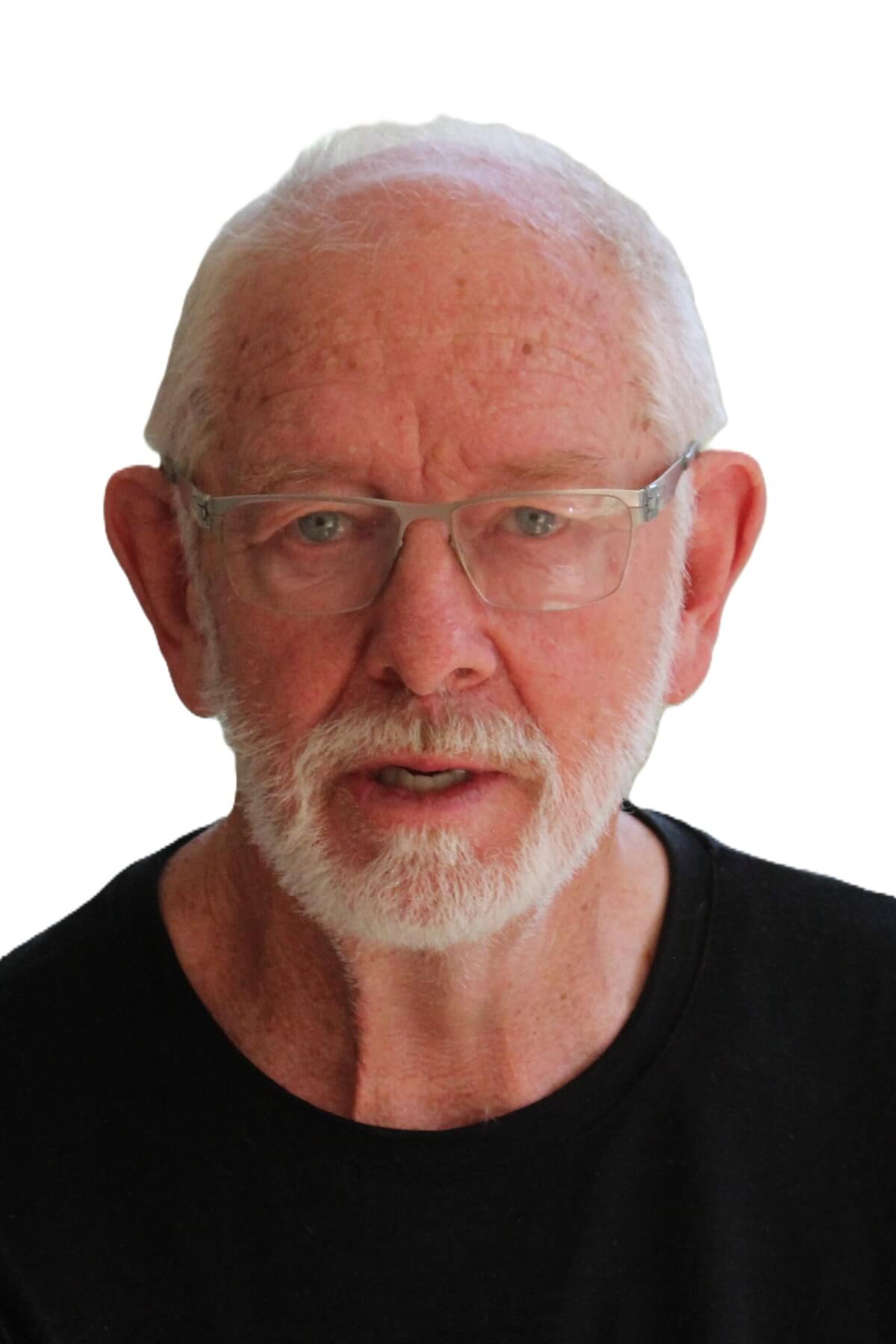

Peter Nicholl

They were widely congratulated and many commentators thought they should reduce the Official Cash Rate by another 25 basic points at their next Official Cash Rate meeting on November 26.

I think the Reserve Bank’s approach is risky for two reasons. First, inflation in New Zealand is not yet under control. The September Consumer Price Index number came out on Monday. It was 3 per cent, right at the top of the Reserve Bank’s target range. The Reserve Bank has eased monetary policy significantly even though they predicted, correctly, that inflation would rise.

That was their first mistake. They said that they expected this increase in the Consumer Price Index ‘to be transitory’ – that the Consumer Price Index would come back within their target range quickly.

They have said this before – and got it wrong. I think this will be their second mistake. Food prices are still rising by around five per cent per a year, power prices, rates and insurance are all still rising by even more. There are a number of large wage claims still unsettled. Our exchange rate is continuing to fall, which adds to import prices. So I am not sure why the Reserve Bank thinks New Zealand’s inflation moving to the top of their target range will be transitory.

My second reason is that the Reserve Bank is taking a much more benign view of global inflation risks than most other central banks. In December last year, the Reserve Bank’s Official Cash Rate was 4.25 per cent, which was equal to the policy interest rate in the United States and similar to those in Australia and the United Kingdom. Since then, the Reserve Bank has reduced its Official Cash Rate by 1.75 per cent. Australia and the UK have reduced their’s by 0.75 per cent and the US by only 0.25 per cent. Yet New Zealand’s inflation rate is currently higher than in the US or Australia. With interest rates in New Zealand now being significantly below those in the US, Australia and the UK, our exchange rate is likely to keep on falling.

The question is are these other central banks being too risk-averse or is the Reserve Bank taking too many risks? I think it is the latter. The Reserve Bank pre-announces the dates on which they will take their Official Cash Rate decisions. They have announced the next nine dates, all the way out to Febraury 17, 2027. I have always thought this was an odd policy as the economy doesn’t move in a smooth fashion and when it is the right time for the Reserve Bank to act can’t be determined in advance.

The timing of the next Official Cash Rate decision illustrates this. It will be on November 26. Five days later Dr Anna Bremen will become the new Governor of the Reserve Bank. But the Reserve Bank seems to think that the economy goes to sleep over the summer break. The gap between Official Cash Rate decisions is usually six to eight weeks. But this summer the gap will be 12 weeks – all the way to February 18, 2026. The Reserve Bank has already taken a risk by significantly lowering its Official Cash Rate at the same time as inflation rose to the top of their target range.

If they lower the Official Cash Rate further on November 26, as most economic commentators are proposing they should do, the new Governor could have a difficult start to her tenure.

Official Cash Rate. Photo: pexels.com