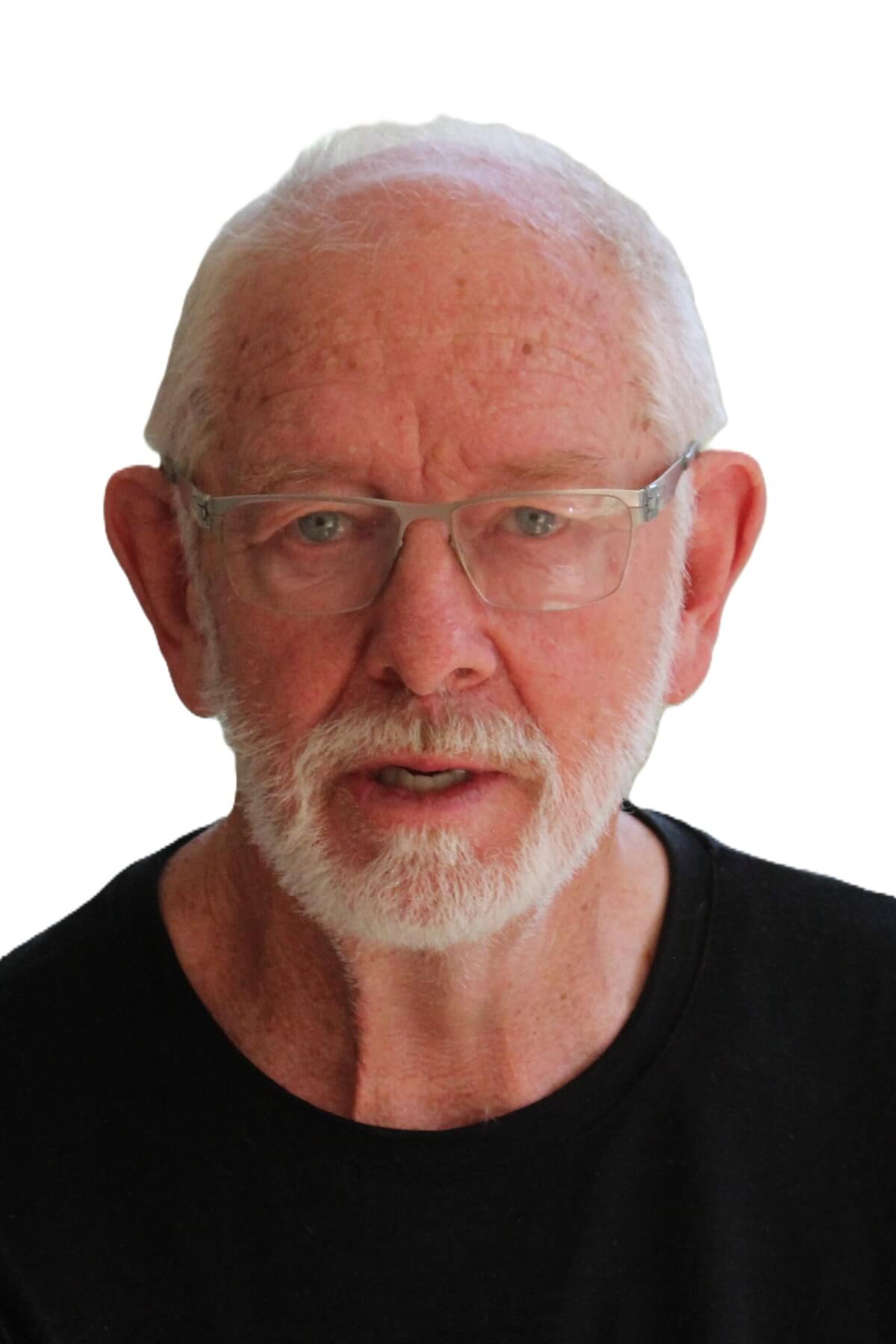

Peter Nicholl

On May 28 the Reserve Bank of New Zealand reduced its Official Cash Rate by 25 basis points to 3.25 per cent.

Peter Nicholl

Before the announcement, the bank got lots of advice from other people about what they should do.

Some said there were good reasons for leaving the OCR where it was.

These included that the inflation rate was still in upper part of the 1-3 per cent CPI target, the annual CPI had risen to 2.5 per cent from 2.2 per cent in March and inflation expectations, which the bank pays a lot of attention to, were also rising again.

I am not surprised that inflation espectations are rising again.

Take Waipā where I live. We are told our rates will rise by 15.5 per cent this year. Why should we expect overall inflation to be around two per cent?

An additional reason was that there was so much uncertainty around, it would be prudent to leave the OCR where it was in the hope that the fog of uncertainty might dissipate in the coming months. I agreed with the ‘advisors’ who took this cautious position.

There were a few people who said the Reserve Bank should be bold and move the OCR by 50 bp in order to help New Zealand’s strugglimg economic growth.

They seem to forget or ignore the fact that one of the first things the current government did after they were elected was to shift the target of the Reserve Bank’s monetary policy from a dual focus on inflation and growth to a single focus on inflation.

But most ‘advisors’ thought the bank should move by 25 bp – and that was what it did.

I find it interesting to compare the bank’s policy approach over the last six months compared to the US Federal Reserve. In December, 2024, the policy interest rate set both were the same.

Since then, the Fed has had three policy meetings and has left its official rate unchanged at all three.

The Reserve Bank has also had three policy meetings and has reduced the OCR at all of them: from 4.25 to 3.75 to 3.5 to 3.25 per cent.

Faced with similar inflation rates, inflation pressures and a high degree of uncertainty, the Fed and the Reserve Bank have taken very different policy approches.

I said in my February 13 column that a lesson learnt early in my policy-making career was that the worst thing for making private sector business decisions and for economic policy decisions was uncertainty.

There was never a time in my over 50 years of policy-making where there was anywhere near as much uncertainty about so many different things as there now.

An enterprising journalist counted how many times the Reserve Bank used the word uncertainty in last week’s Monetary Policy Statement – it was 164 in 62 pages.

Despite all this uncertainty, the bank still decided to lower their OCR. Is that bold, hopeful or foolish? I fear the answer will be foolish.

Peter Nicholl